LTC Price Prediction: Breaking $120 Resistance Could Fuel Rally to $134-$141

#LTC

- Technical indicators show LTC trading above key moving averages with bullish momentum building

- Regulatory developments including SEC guidelines and ETF streamlining reduce uncertainty

- Whale accumulation of 181K tokens signals strong institutional confidence in LTC's prospects

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Breakout Potential

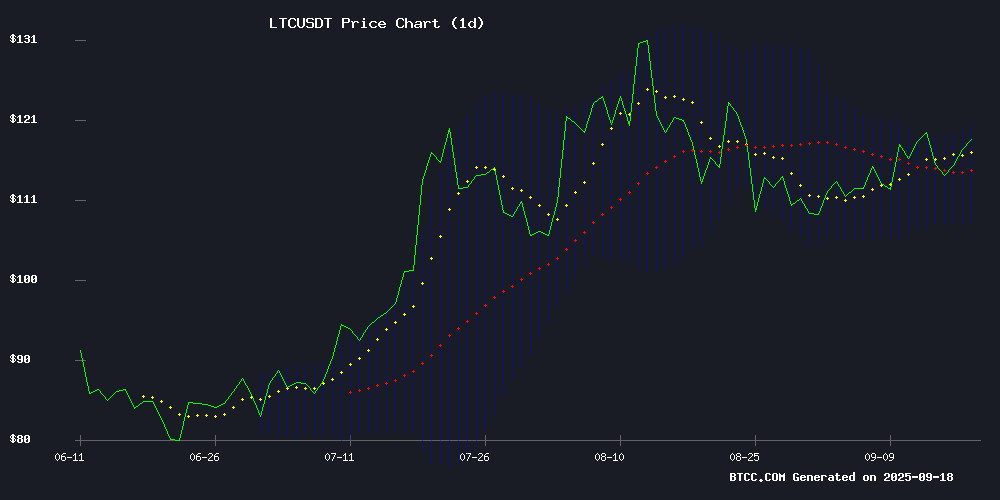

LTC is currently trading at $117.64, above its 20-day moving average of $113.86, indicating positive momentum. The MACD reading of -2.57 remains negative but shows improving momentum with the histogram at -1.996. The price is approaching the upper Bollinger Band at $119.81, suggesting potential resistance. According to BTCC financial analyst John, 'LTC's position above key moving averages and approaching upper Bollinger Band indicates strengthening bullish sentiment. A sustained break above $120 could trigger further upside movement.'

Market Sentiment: Regulatory Clarity and Whale Activity Support LTC

Recent developments including the SEC's streamlined ETF approval process and new crypto guidelines are creating positive regulatory tailwinds for Litecoin. Significant whale accumulation of 181K LTC tokens above $115 demonstrates institutional confidence. BTCC financial analyst John notes, 'The combination of regulatory progress and substantial whale accumulation suggests growing institutional interest. The SEC's updated guidelines provide clearer framework for crypto assets, reducing regulatory uncertainty that has previously weighed on prices.'

Factors Influencing LTC's Price

Canada Seizes $56M in Bitcoin, XRP, and Other Cryptocurrencies in Major Exchange Shutdown

Canadian authorities have confiscated $56 million CAD ($40.5 million USD) in digital assets, marking the country's largest crypto seizure to date. The Royal Canadian Mounted Police (RCMP) shuttered TradeOgre, a non-compliant cryptocurrency exchange, following a tip from European agencies.

Investigators seized Bitcoin (BTC), Ethereum (ETH), XRP, Litecoin (LTC), Tron (TRX), and Qubic from the platform, which allegedly facilitated criminal transactions. "The majority of funds transacted on TradeOgre came from criminal sources," stated the RCMP, highlighting the exchange's lack of KYC protocols as a money laundering risk.

TradeOgre's website now displays a seizure notice after months of operational failure. The enforcement action underscores growing regulatory scrutiny on anonymous crypto transactions globally.

Litecoin (LTC) Price Prediction: Resistance Breakout Could Signal Rally to $141

Litecoin hovers near $117, testing a critical resistance level at $120. A decisive breakout could propel LTC toward $141.54, with further upside potential to $194.22. Trading volumes remain subdued, reflecting cautious market sentiment.

Technical indicators paint a neutral picture—RSI at 49.25 and MACD hovering near equilibrium. Analysts note Litecoin's rebound from Fibonacci support suggests underlying strength. "The bounce signals accumulation," says ROSE Premium Signals. "Breaching resistance may trigger accelerated gains."

Institutional interest grows as Grayscale files for a Litecoin ETF. On-chain data reveals whales accumulated 181,000 LTC in a single day—the largest spike in months. This institutional footprint contrasts with retail trader hesitancy.

Why Litecoin Rally Is More Likely Than Ever as SEC Issues New Guidelines

The SEC's approval of generic listing standards for commodity-based trust shares, including digital assets like Litecoin, marks a significant regulatory shift. This decision streamlines the process for listing new spot crypto ETFs or ETPs, reducing timelines from months to weeks. For Litecoin, a cryptocurrency known for its reliability, this development opens the floodgates for institutional investment.

Jamie Selway, Director of Trading and Markets at the SEC, described the move as "much needed regulatory clarity and certainty." The new guidelines allow major national exchanges to offer products tracking commodities, including digital assets, without the lengthy SEC review process for each listing. This could lead to a surge in Litecoin-based investment products, providing institutional investors with regulated exposure to the asset.

SEC Reviews New Wave of Crypto ETF Filings Featuring Avalanche, Sui, and Bonk

The U.S. Securities and Exchange Commission is facing another surge of cryptocurrency ETF applications, with asset managers pushing the envelope on product diversity. Filings range from infrastructure-focused offerings like Avalanche (AVAX) and Sui (SUI) to memecoin-based products such as Bonk (BONK), alongside complex strategies including basis trading and leveraged instruments.

Bitwise leads with a spot Avalanche ETF and a Stablecoin & Tokenization ETF, while Defiance targets Bitcoin and Ethereum basis trades. Tuttle Capital's "Income Blast" funds cover Bonk, Litecoin (LTC), and Sui, and T-Rex proposes a leveraged 2x Orbs ETF. Analysts note simpler products like Bitwise's Avalanche ETF stand the best chance of approval amid the SEC's growing backlog of 90+ pending crypto ETFs.

SEC Approves Generic Listing Standards to Streamline Crypto ETF Approvals

The U.S. Securities and Exchange Commission has greenlit generic listing standards for spot crypto ETFs, eliminating the need for individual assessments of each application. The move significantly accelerates the approval process under Rule 6c-11, with filings already submitted to Nasdaq, NYSE Arca, and Cboe BZX.

"This ensures America's capital markets remain the global leader in digital asset innovation," said SEC Chair Paul Atkins. The decision reduces barriers to entry while expanding investor access to crypto products within regulated markets.

The regulatory shift comes as multiple spot ETF applications await review, including proposals for Solana (SOL), Ripple (XRP), and Litecoin (LTC) products. Market observers anticipate this could trigger a new wave of institutional crypto adoption.

Arca CIO Challenges Notion of Broad-Based Crypto Bull Market in 2025

Jeff Dorman, Arca's Chief Investment Officer, disputes the characterization of 2025 as a true crypto bull market, noting that only select large-cap tokens are driving gains. Over 75% of tracked assets are negative year-to-date, with half down 40% or more. Memecoins and speculative assets like Litecoin (LTC) and Bitcoin Cash (BCH) have outperformed, while serious investors focus on Bitcoin (BTC), Ethereum (ETH), and other established names.

The divergence mirrors traditional finance, where blue chips rally while small caps languish. Dorman views this selectivity as healthy—forcing investors to scrutinize projects rather than ride indiscriminate momentum. "Nothing good comes from an everything rally," he observes, emphasizing that weak projects' failures prompt necessary scrutiny.

CoinDesk 20 Index Rises 2.8% as All Constituents Post Gains

The CoinDesk 20 Index surged 2.8% to 4,391.98, with every constituent asset trading higher. Avalanche (AVAX) led the rally with a 10.4% gain, followed closely by Bitcoin Cash (BCH) at 7.8%. Even the laggards—Filecoin (FIL) and Litecoin (LTC)—managed modest 0.9% advances.

This broad-based rally reflects growing institutional confidence in digital assets. The index, traded globally across multiple platforms, serves as a barometer for crypto market health. Such uniform upward movement suggests capital is flowing into the sector rather than rotating between tokens.

LTC Price Surges Above $115 as Whales Accumulate 181K Tokens

Litecoin's price surged to $115.75, marking a 1.26% gain within 24 hours, as large-scale investors acquired 181,000 LTC tokens in a single trading session. This accumulation, valued at approximately $21 million, signals growing institutional confidence in the cryptocurrency.

Technical indicators reinforce the bullish momentum, with Litecoin's MACD histogram showing positive divergence. The asset currently trades above its 20-day moving average, suggesting potential for further upside. Market sentiment remains cautiously optimistic amid a lack of negative catalysts.

Whale activity of this magnitude often precedes significant price movements, as sophisticated investors typically position themselves ahead of market trends. The timing of these accumulations coincides with Litecoin demonstrating renewed strength against USDT pairs.

PACT SWAP Expands Cross-Chain Trading with Dogecoin and Polygon Support

PACT SWAP, a bridgeless decentralized exchange, has integrated Dogecoin (DOGE) and Polygon (POL), enabling native cross-chain swaps across seven major networks. The platform now supports Bitcoin, Ethereum, BNB Chain, Litecoin, TRON, Dogecoin, and Polygon without relying on wrapped assets or bridges.

The move aligns with PACT SWAP's goal to rival centralized exchanges in trading pair diversity and pricing—while maintaining decentralization. Cross-chain liquidity is critical for mainstream adoption, and the platform's approach reduces user complexity and risk by eliminating intermediaries.

Further enhancements to user experience and asset coverage are underway as the team explores additional blockchain integrations.

SEC Streamlines Process for Crypto Spot ETFs with New Listing Rules

The U.S. Securities and Exchange Commission has introduced a regulatory breakthrough, adopting generic standards to accelerate approvals for spot cryptocurrency ETFs. This move eliminates the need for individual filings, allowing exchanges to list qualifying digital asset trusts under a unified framework.

Market analysts view this as a watershed moment for institutional crypto adoption. The streamlined process replaces the cumbersome Section 19(b) evaluations that previously delayed approvals for months. While some commissioners expressed reservations about crypto market risks, the decision signals growing regulatory acceptance of digital assets.

Litecoin Eyes $134 Target Amid Bullish Momentum

Litecoin's price trajectory suggests a potential 16% surge to $134 by month-end, fueled by bullish technical indicators and a decisive break above the $120.83 resistance level. The cryptocurrency currently trades at $115.57, with immediate support at $106.38 and stronger footing at $103.16.

Analyst consensus remains tightly clustered between $129.40 and $134.92, reflecting confidence in LTC's near-term upside despite its current consolidation phase. The September 18th forecast of $134.92 stands as the most optimistic projection, though all predictions carry medium confidence levels—acknowledging both the opportunity and technical hurdles ahead.

Market watchers note the 17% gap between current prices and analyst targets, with MACD momentum and broader market conditions expected to drive the next leg upward. The $122-125 range presents an intermediate hurdle before testing higher resistance zones.

Is LTC a good investment?

Based on current technical indicators and market developments, LTC presents a compelling investment opportunity. The cryptocurrency is trading above key moving averages with strong whale accumulation indicating institutional confidence. Regulatory clarity from the SEC's new guidelines and streamlined ETF processes provide additional support.

| Indicator | Current Value | Signal |

|---|---|---|

| Price | $117.64 | Bullish |

| 20-day MA | $113.86 | Above MA (Bullish) |

| Bollinger Upper | $119.81 | Approaching Resistance |

| MACD | -2.57 | Improving Momentum |

BTCC financial analyst John suggests that a break above $120 could target the $134-$141 range, making LTC an attractive investment for those with moderate risk tolerance.